Alberta-Power, Part 1: A New Paradigm

The Alberta Power Market is evolving rapidly. It has been frontpage news within Canada for the past months, mainly due to extreme price spikes, near-blackout situations during a January extreme cold spell, and a temporary moratorium on new renewables permits. It is the only (largely) deregulated electricity market in Canada, with an “Energy Only” market design.

As with any rapid market changes, there will be winners and losers. At first glance, the biggest economic risk exposure is to Cogen facilities with excess electricity generation, but dispatchable loads could turn this exposure into a large opportunity. More on that later.

It is worthwhile examining the market in more detail, evaluating scenarios of likely outcomes, and outlining some of the resulting opportunities. Given the complexity of the topic, this blog is split into 3 parts:

Part 1: A New Paradigm

[This article is not financial or investment advice, but provided for general information purposes only. All information is subject to change and should not be relied upon for any decision making. See Webpage Terms of Use.]

Market design

The Alberta power market is “energy only”. This means that with few exceptions for ancillary services like spinning reserve, generators are compensated only for the energy they generate, not capacity provided.

“Market participants who wish to buy or sell electricity submit several supply offers and demand bids to the market on a day-ahead basis for every hour, 24 hours a day. These supply offers and demand bids are sorted from the lowest to highest price for each hour of the day into a list called a merit order. (...) Every minute, the highest priced offers/bids submitted from the market, and dispatched by System Controllers, is designated as the System Marginal Price (SMP). Each hour, the pool price is calculated by averaging all 60 of these one-minute SMPs.” (excerpt from “How the Pool Price is determined” by the Alberta Electric System Operator (AESO)).

The AESO dashboard provides great near-real time snapshots of the market. The allowed price range is CAD 0/MWh to CAD 1,000/MWh, i.e. negative prices are not allowed.

Electricity Demand

Average Alberta Internal Load (AIL) was 9.9 GW in 2023 with a minimum of 7.9 GW. It reached a historic high of 12.4 GW during the extreme cold of January 2024. Average 2023 load was 0.3% lower than in 2022 due to overall milder temperatures, and about flat accounting for temperatures. Please refer to the (extremely well written and insightful) AESO 2023 Market Statistics report for more information.

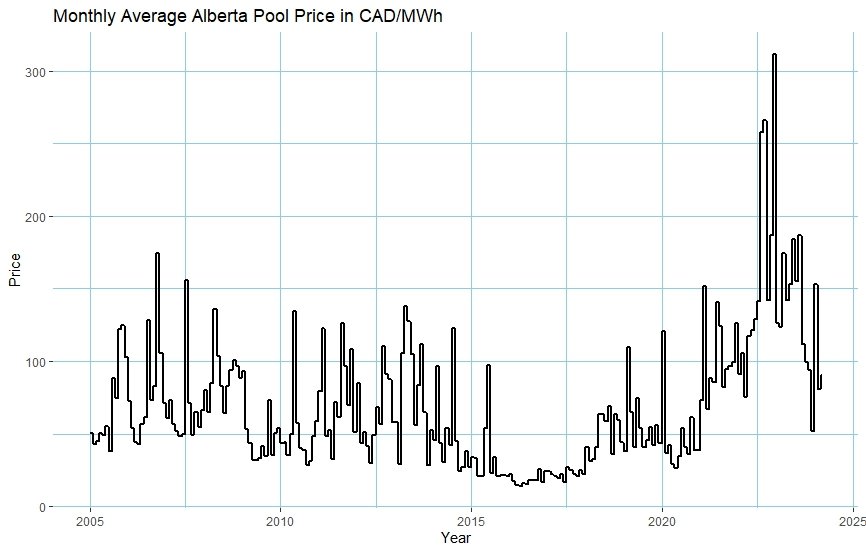

Price History

The period from 2015-2018 was marked by very low prices, which led to underinvestment during that period - and a sharp increase in prices and price volatility since 2020. The graph below showing average monthly pool prices since 2005 illustrates this history.

Supply and Supply Growth

As usual in commodity markets, the best cure for high prices are high prices, and the recent high prices plus interest in renewables have driven an investment boom. Installed generation capacity increased by 13.3% in 2023 to 20.8 GW, with 1.4 GW of the growth coming from renewables and 0.9 GW from gas - importantly, the new gas capacity did not produce energy yet in 2023 due to commissioning activities (thus counted toward 2024 in the following sections).

Even bigger generation growth will occur in 2024, with over 5 GW of new generation capacity expected to come online:

1.9 GW gas, including Suncor’s Base Plant Cogen with 0.8 GW and 0.9 GW at Kineticor’s Cascade Combined Cycle Plant near Edson

1.4 GW wind, primarily in central and south-east Alberta

1.9 GW solar, primarily in central and south-east Alberta

Further significant capacity has already received the required permits.

As a result, the supply cushion (the difference between the daily available firm supply minus daily peak demand, i.e. excluding non-dispatchable renewables) will increase substantially from Q2 2024:

Excerpt from the AESO’s February 2024 Long-term adequacy metrics report.

Average prices and volatility were very high in 2022 and 2023 driven by the low supply cushion and high market concentration. Adding almost 2 GW of baseload & dispatchable gas power plant capacity should significantly reduce upward price pressures during dark and windstill periods, with total firm capacity exceeding forecast demand by over 2GW most of the time.

Then comes the non-dispatchable new capacity. Around the end of 2024, wind and solar nameplate generation capacity should exceed 9 GW - thus when the wind blows and the sun shines, those two technologies should be able to provide around 90% of Alberta’s electricity demand.

Cogen facilities are particularly hard to take offline (and restart) though, thus the huge additions of wind and solar capacity will almost certainly lead to significant periods of excess supply and even curtailment. Whilst Cogen facilities will likely be provided a higher priority for staying online due to restart complications, they would need to sell their electricity at zero dollar prices during these hours. Wind & solar facilities that cannot be dispatched will likely be disproportionately affected as well; solar assets may be a bit better off at least initially (until they reach a certain critical size) as their production is naturally more correlated with peak hours than wind assets.

The below excerpt from the AESO 2023 Market Statistics report shows the relative prices achieved in past years by asset - with cogen relatively “flat” compared to average pool prices as they tend to be “always on”, solar benefiting from the mentioned correlation with peak demand, and wind being impacted from off-peak supply and its own success.

To illustrate the exposure, the biggest net Cogen capacity owner Suncor reported CAD 464 mln of net excess electricity sales revenue in 2023 against an average pool price of CAD 133.65 / MWh. With average pool prices likely decreasing significantly in 2024, a lot is at stake. But as indicated earlier, some big opportunities come with this development!

Next, Part 2 looks at key price statistics in more detail, and Part 3 will address those exciting opportunities.