Alberta-Power, Part 3: Opportunities

[This article is not financial or investment advice, but provided for general information purposes only. All information is subject to change and should not be relied upon for any decision making. See Webpage Terms of Use.]

Part 1 and Part 2 of this series came to three main conclusions:

The large number of both gas and renewable power assets coming online over the next 12-18 months will very likely lead to a significant number of low/zero dollar pool price hours per day, with likely increasing curtailments

The impact on average prices and peaks is likely a significant reduction, but this is less clear than the significant increase in low/zero dollar hours mentioned in point 1

By extension, without mitigating measures, all power producers will likely see significant revenue reductions, with wind, solar and Cogen facilities most impacted

Part 3 will talk about resulting opportunities. Why focus on Opportunities and not Risks? We need more optimism in the energy debate, and it’s not a zero-sum game between existing and new generation, suppliers and customers. The “pie” can grow, with lower overall emissions.

This article focuses on three opportunity types:

Batteries

Intermittent hydrogen production

Electro Thermal Energy Storage (ETES)

To take the main conclusion up front: the least-known and least-discussed technology, ETES appears to present the biggest opportunity. Batteries also have large potential provided transmission tariff adjustments, and hydrogen faces (very) big cost challenges.

The Opportunity: Low-cost hours

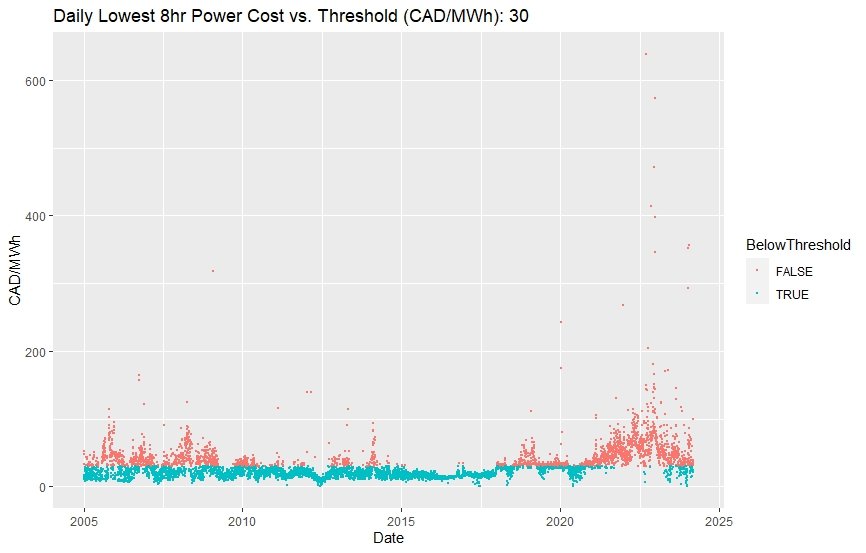

As a quick recap, below is the overview of the average cost of the lowest-cost 8 pool price hours per day since 2015, with green dots representing a price below CAD 30/MWh and red dots representing a price above that threshold:

As outlined in more detail in Part 2, the recent and coming capacity additions will likely lead to a significant increase of such low/zero price hours, with wind, solar and cogen projects being most exposed. A big opportunity exists in utilizing the low cost of electricity during these hours to shift supply with batteries, or applying dispatchable loads like intermittent hydrogen production or Electro-Thermal Energy Storage.

Batteries

Utility scale battery systems have seen astonishing growth in other markets over the past two years. The simplest concept for battery utilization would be power price arbitrage - buy cheap power, store it in the battery, and sell it back to the grid at higher prices. The main problems in Alberta:

Transmission Tariffs - almost punitive at the moment for batteries, see “Detour” below. Change may come via a more workable interim solution that will likely be submitted to the Alberta Utility Commission for approval soon, see AESO Engage for details.

Upside uncertainty - with the significant expansion of gas capacity, the overall price level may also reduce and the frequency of (extremely) high price spikes reduce accordingly, reducing battery earnings potential.

As a result, storage market growth has lagged in Alberta. (Even other energy-only markets such as Texas / ERCOT have seen very strong growth in battery deployment, thus there is a chance that Alberta may catch up once transmission tariffs are fixed).

Pairing batteries with intermittent renewable generation has a more straightforward business case: not only can the shift to higher-priced hours generate more revenue, but the flattening of the supply curve can also enable much larger renewable projects where (peak) transmission capacity is scarce. It can also reduce unit capex of solar projects by enabling a higher DC:AC ratio (Inverter Load Ratio, “ILR”), as transmission capacity is often a key factor in ILR sizing.

Prediction: Batteries will likely become a standard “bolt-on” feature for most renewable power projects soon, and may grow rapidly once transmission tariffs are “fixed”.

Detour - Alberta Electricity Transmission Tariffs

A VERY simplified but hopefully still useful summary of key aspects of the current Alberta electricity transmission tariff. The cost of Firm Demand Transmission(Demand Transmission Service, “DTS”) is higher than the cost of Interruptible Demand (Demand Opportunity Service “DOS”), and storage services are not well catered for at the moment, often not qualifying for rate DOS and having to pay rather punitive transmission costs. Since interruptible DOS is cheaper than firm DTS yet in practice still “almost firm”, market participants need to apply for access to DOS with annual business cases to reduce the risk of DTS demand cannibalization. Contrast this for example with NGTL gas transmission tariffs - firm FT-D is cheaper than interruptible IT-D, removing most of the incentive for participants to substitute firm with interruptible capacity. And interruptible storage service, IT-S, is free, as it is beneficial for overall market stability. The reason for electricity tariffs being so different seem to be historic market developments and different definitions of “fairness” by key stakeholders. There appears to be a realization now that electricity tariffs and the overall market need an overhaul. Corresponding efforts are underway - but as usual in markets with many stakeholders, this may take a while.

Intermittent Hydrogen Production

The concept of using cheap or free intermittent electricity to generate hydrogen via electrolyzer sounds logical. And it may work well for certain applications, such as assets that were already planning to use electrolyzers for green hydrogen production that can now use lower electricity cost assumptions.

The main problem is cost: green hydrogen is prohibitively expensive for most applications even with (unrealistically) optimistic cost assumptions.

A rather efficient electrolyzer system uses about 50kWh electricity to produce 1kg Hydrogen. Using the CAD 30/MWh “threshold” for low cost electricity, and assuming zero electrolyzer Capex & Opex, would result in CAD 1.5/kg green Hydrogen. This also happens to be slightly below current grey hydrogen costs (note that this green hydrogen cost is completely unrealistic, given the zero Capex / Opex assumptions, but ignoring that aspect for now as it helps to demonstrate the huge cost challenge for hydrogen). Each kg hydrogen contains 39.4 kWh/kg energy at Higher Heating Value (HHV, which assumes latent heat of water vaporization can be recovered), or 33.3 kWh/kg at Lower Heating Value (LHV), which is the appropriate value for most applications. With the above assumptions, the cost of green Hydrogen would thus be about CAD 45/MWh at LHV, CAD 38/MWh at HHV.

For Natural Gas, the equivalent values are around 13.1 kWh/kg LHV, 14.5 kWh/kg HHV. Each GJ of Natural Gas weighs about 18.6kg. Thus at Canadian forward gas prices of around CAD 3/GJ, Natural Gas costs about CAD 12.3/MWh at LHV and CAD 11.1/MWh at HHV. In other words, even assuming zero electrolyzer cost the green hydrogen would cost roughly 3.5 times as much as Natural Gas.

But how about associated emissions reductions and thus carbon tax savings? With the above assumptions, the green hydrogen premium over NatGas would be about CAD 33/MWh at LHV and CAD 27MWh at HHV. The emissions from burning 1GJ (244kWh at LHV / 270kWh at HHV) of Natural Gas are about 50kg CO2, thus about 205kg CO2/MWh at LHV, 185kg CO2/MWh at HHV. Assuming an equivalent conversion efficiency of Hydrogen and NatGas for the use case (e.g. hydrogen blending into NatGas network), the green hydrogen would abate ~200kg of CO2 per MWh of hydrogen used. Using the “green premium” calculated above, the implied cost per tonne of CO2 avoided would be ~ CAD 160/tonne at LHV and CAD 146/tonne at HHV. This is high - and even this number required the unrealistic zero dollar Capex & Opex assumptions. It would also require the electrolyzer to run intermittently, further driving up unit Capex and Opex.

In short, intermittent green hydrogen production is a high hanging fruit even in the best case scenario.

(For anyone interested in more details on hydrogen economics and use cases, I would recommend Paul Martin’s hydrogen series. He expresses strong opinions about the (lack of) business case for most hydrogen use cases, but supports his views with detailed first-principles based analysis. Very worth reading given the well-substantiated calculations and conclusions.)

Prediction: Hydrogen production from intermittently cheap (green) electricity may grow, but nowhere near as fast as some forecasts suggest, even with subsidies and an increasing carbon price.

Electro-Thermal Energy Storage (ETES)

ETES systems convert electricity into heat and store that heat in a heat battery, from which heat can be released as required by the customer. About 30 companies are active in this space, with a good overview in this recent article.

Simpler is usually better, and most ETES systems are just that. Rondo Energy’s system for example is essentially a “toaster in bricks”. The “toaster” heats the “bricks” whenever electricity is cheap, and the bricks store heat at up to 1,500C, releasing it continuously or whenever needed for example into a steam generator. Each Rondo battery can store between 100-300 MWh of heat, exceeding the energy density of Li-Ion batteries yet with much lower cost. Industrial heat demand is huge, for end uses ranging from process steam to cement production to food processing to aggregate drying. The heat energy demand of the oil sands industry in Alberta alone is about twice as big as the electric energy demand in the province.

ETES technology is finally scaling, driven by industry’s need for decarbonization and more intermittently (very) cheap electricity from renewables. Significant amounts of venture capital for the technology has been provided by large oil & gas and industrial firms, for example Shell (Kraftblock, Antora Energy), Saudi Aramco & SABIC (Rondo Energy) and Rio Tinto (Rondo Energy).

Combining the huge demand for heat & steam decarbonization with electricity during near-zero pool price hours most days and with a low Capex heat battery makes for a great business case. Transmission costs can present a challenge but can also be avoided by pairing heat demand with nearby power supply. For example, wind / solar / cogen units that would otherwise produce into a zero-dollar market or be curtailed can instead power a nearby ETES unit during those hours, replacing fossil-fuel fired heat / steam generators with emissions-free electricity. Even when the electricity comes from a gas-fired cogen unit, it creates space on the grid for otherwise curtailed renewables and avoids direct emissions. And economically, this is significantly cheaper than adding post-combustion CCS in most situations.

More details and calculations in a dedicated article to be published soon!

Prediction: Huge growth once established. ETES technology remains largely unknown in Canada and is only now starting to scale in other markets, thus may take a bit longer to catch on. But given its relative simplicity, ability to scale and superior economics compared to e.g. CCS and small nuclear reactors the ETES market will grow very quickly once demonstrated in local applications.

At Arder Energy, we spent significant amounts of time to understand ETES technology and its applicability in different contexts. We have established relationships with key technology providers and will shortly commence project conceptualization. Contact us to explore how ETES can add value to your operations.