Alberta Power Market Snapshot: November 2025

A late fall with "warm" weather halfway through the month, then a rapid start of winter conditions. November was yet again highly interesting for the Alberta power market: while the monthly average pool price was quite "average", it didn't really tell the story, as we saw very high volatility and another record for zero-dollar hours. This holds significant implications for large power consumers.

[This article is not financial or investment advice, but provided for general information purposes only. All information is subject to change and should not be relied upon for any decision making. Copyright 2025 Arder Energy™. All rights reserved. See Webpage Terms of Use.]

The Data

As usual, we start with the big-picture view, the heat map of hourly pool prices:

Heat Map of November 2025 hourly Alberta power pool prices

Vertical axis: hour of the day, from hour 0 on top to hour 24 at the bottom.

Horizontal axis: day of the month, from 1st to 30th.

Colors: Pool price, with each block representing one hour

black - “zero-dollar” (CAD 0/MWh);

grey - “ultra cheap” (CAD 0.01-30/MWh),

light green - “cheap” (CAD 30-50/MWh),

dark blue - “normal” (CAD 50-70/MWh),

yellow - “expensive” (CAD 70-100/MWh),

orange - “very expensive” (CAD 100-300/MWh)

red - “extremely expensive” (CAD 300-500/MWh)

maroon - “peak prices” (CAD 500-1,000/MWh)

We can quite clearly see the change in weather patterns in the middle of the month, with unusually warm and quite windy & sunny weather in the early weeks leading to a large number of zero-dollar prices (black), albeit combined with periods of (near-)peak prices mainly during the evening ramp. And then a much more “boring” pattern during the last ten days of November, when prices mainly meandered between (ultra-)cheap and moderately expensive levels.

With every price level being present during this month, making more sense of the data requires some summary statistics.

The average monthly pool price came in at CAD 57.64/MWh, which is both the 11th-highest and the 11th-lowest level since 2005, i.e. quite average:

November average Alberta electricity pool prices, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted

But as we keep highlighting, averages are often deceiving.

Our proxy for the value available to flexible loads, the average of the lowest-cost daily 8 hours, was at the fourth-lowest level since 2005, at CAD 17.65/MWh:

Daily lowest-cost 8 hours, average for November, 2005-2025 (CAD/MWh)

Prices are not inflation-adjusted

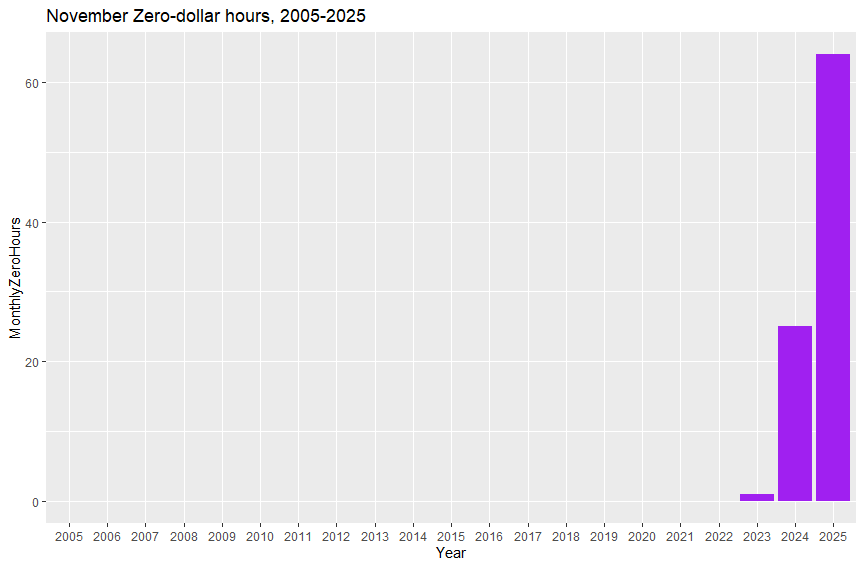

And as highlighted in the beginning, we set yet another monthly record for zero-dollar hours, which are also a great proxy for temporary Excess Supply and generation curtailment. At 64, their number was 156% higher than last year, which itself had set a record for the month of November. Previously, there had been at most one such hour during this time of the year in at least 2 decades. The market is shifting, in a big way:

Monthly zero-dollar hours for November, 2005-2025

Takeaways

Our core thesis holds true: structural change is rapidly reshaping the Alberta power market. With the deepest regulatory reforms since the 2001 market liberalization commencing shortly, and significant new data center loads under development, this transformation is set to accelerate significantly.

Strategic Insight for Large Power Consumers

Everything is shifting - markets, technology, regulations. If you are a large power consumer, now is the time to assess your power strategy. If your company has not examined its power bills lately, you can almost certainly achieve significant savings, without needing to spend any Capex. We know how and would love to work with you - please get in touch!

Contact us today to schedule a 30-minute market assessment and explore immediate savings opportunities.

Power Training for Deal Makers

Join us for a full-day training course covering the foundations of Alberta’s Electricity Market, designed for industry professionals and business leaders supporting the industry.

At the end of the course, you will be able to:

Decode industrial power bills and identify cost-saving opportunities

Negotiate more effectively with your electricity provider

Prepare for the implications of Alberta’s power market restructuring in 2026

The number of seats is limited to maximize opportunities for interaction and discussion, and we expect a sold-out event - sign up now!